The United Arab Emirates (UAE) is undergoing a massive industrial shift, driven by ambitious national projects, a robust healthcare transformation, and energy diversification. With these dynamic developments, the demand for a wide range of industrial and specialty chemicals has surged.

From polymer resins for infrastructure to pharmaceutical-grade solvents and oilfield enhancement chemicals, the UAE is now one of the most attractive chemical markets in the Middle East. This article offers a deep dive into the emerging chemical demand across three core sectors: Infrastructure, Healthcare, and Energy.

Why the UAE’s Chemical Market Is Booming

The UAE government’s long-term strategies—such as Vision 2030, Operation 300bn, and Energy Strategy 2050—are propelling industrial diversification.

Key growth drivers include:

-

Massive construction and smart city projects across Dubai, Abu Dhabi, and Sharjah.

-

Healthcare infrastructure expansion, especially after COVID-19.

-

Oilfield innovation and renewable energy investments.

Sector 1: Infrastructure and Construction

🏗️ Overview

The UAE construction market is projected to reach USD 133.5 billion by 2027. The sector relies heavily on:

-

Construction chemicals (e.g., admixtures, sealants)

-

Polymers and resins (e.g., PVC, PE, epoxy resins)

-

Protective coatings and waterproofing agents

🔹 High-Demand Chemicals in Infrastructure

| Chemical | Use Case | UAE Demand Factor |

|---|---|---|

| Polyvinyl Chloride (PVC) | Pipes, flooring, insulation | Used in 70% of UAE’s real estate projects |

| Epoxy Resin | Coatings, adhesives | High humidity resistance in coastal cities |

| Bitumen Emulsions | Road construction, waterproofing | Smart city road networks & Expo legacy infrastructure |

| Fly Ash | Cement additive | Green building push for sustainability certification |

| Silica Fume | Concrete reinforcement | Structural projects like metro, airports |

📌 Case Example

Dubai Creek Harbour, a multi-billion-dollar mega project, imported over 20,000 metric tons of PVC and epoxy resins in 2024 alone for piping, insulation, and structural coating.

Sector 2: Healthcare and Pharmaceuticals

🏥 Overview

The UAE’s healthcare expenditure is expected to grow at 7.5% CAGR, reaching USD 26 billion by 2026, according to Alpen Capital. This rapid evolution fuels demand for pharma-grade chemicals, disinfectants, and lab reagents.

🔹 High-Demand Chemicals in Healthcare

| Chemical | Application | Demand Insight |

|---|---|---|

| Ethanol (99%) | Hand sanitizers, pharma solvents | Post-pandemic hygiene culture sustains demand |

| Hydrogen Peroxide | Disinfectants, antiseptics | Used across hospitals and laboratories |

| Acetonitrile | HPLC solvent for pharma analysis | Growing diagnostic labs in Dubai Healthcare City |

| Sodium Hypochlorite | Surface cleaning | UAE mandates institutional use in all clinics |

| Isopropyl Alcohol (IPA) | Wound cleaning, sanitizer base | Medical-grade IPA is in consistent demand |

📌 Case Example

In 2023–24, the Dubai Health Authority (DHA) ordered bulk imports of ethanol and hydrogen peroxide worth AED 35 million, primarily from India and Germany, to maintain hospital hygiene standards.

Sector 3: Oil, Gas & Renewable Energy

⚡ Overview

The UAE continues to be a global leader in oil and gas exports, but it’s also investing billions in hydrogen, solar, and carbon capture. Both traditional and new energy sectors rely heavily on chemicals for extraction, purification, and efficiency.

🔹 High-Demand Chemicals in Energy

| Chemical | Primary Use | Relevance in UAE Energy Sector |

|---|---|---|

| Corrosion Inhibitors | Oil pipelines and drilling | Protects rigs and offshore platforms |

| Biocides | Oilfield water treatment | Prevents microbial growth in oilfield water systems |

| Ammonia | Green hydrogen production | UAE to be a major ammonia exporter by 2030 |

| Polyacrylamide | Enhanced oil recovery (EOR) | ADNOC investing in chemical EOR technologies |

| Sodium Hydroxide (Caustic Soda) | Oil refining, desulfurization | Used in both petroleum and gas refining |

📌 Case Example

ADNOC, the national oil company, allocated USD 500 million for chemical-based enhanced oil recovery (EOR) projects using polyacrylamide in 2024, sourced primarily from Saudi Arabia and China.

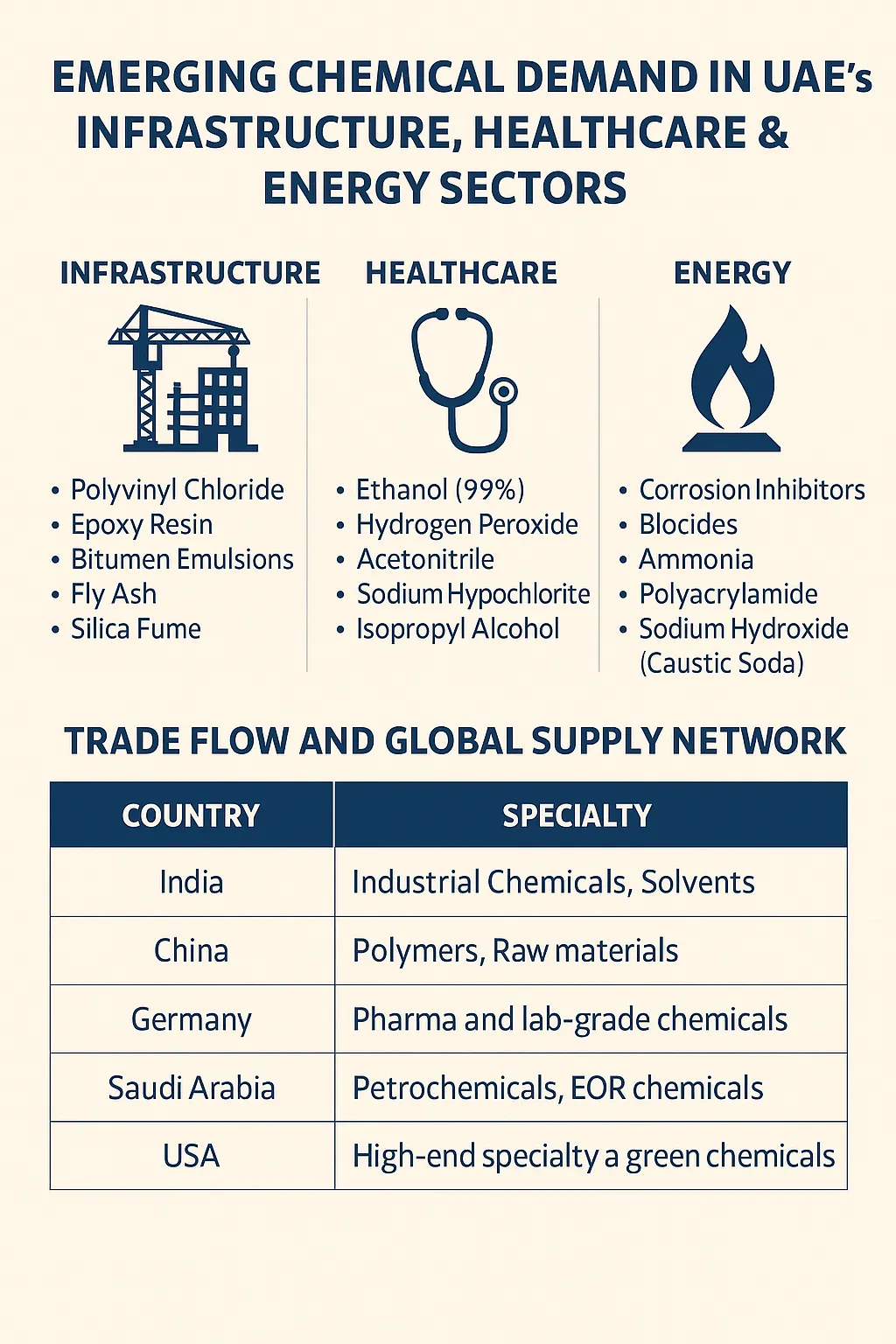

Trade Flow and Global Supply Network

The UAE imports chemicals from across the world and redistributes to the GCC and African countries. The major source nations include:

| Country | Specialty | Share in UAE Chemical Imports |

|---|---|---|

| India | Industrial chemicals, solvents | 28% |

| China | Polymers, raw materials | 23% |

| Germany | Pharma and lab-grade chemicals | 15% |

| Saudi Arabia | Petrochemicals, EOR chemicals | 12% |

| USA | High-end specialty and green chemicals | 8% |

Challenges & Opportunities

Challenges

-

Strict regulatory approvals (Dubai Municipality, ESMA)

-

High transportation costs due to hazardous nature

-

Competitive pricing pressure from regional suppliers

Opportunities

-

Localization: Companies setting up chemical blending plants in UAE free zones

-

Eco-certifications: Supplying biodegradable and green-certified chemicals

-

Smart Logistics: AI and blockchain used in warehousing and chemical traceability

Future Forecast: UAE Chemical Demand Through 2030

A forward-looking projection reveals sharp growth across all three sectors:

| Sector | 2024 Market Size | Projected 2030 Size | CAGR (2024–2030) |

|---|---|---|---|

| Infrastructure | USD 10.8 Billion | USD 17.4 Billion | 8.3% |

| Healthcare | USD 8.5 Billion | USD 14.2 Billion | 7.5% |

| Energy | USD 14.0 Billion | USD 22.6 Billion | 8.2% |

Conclusion

From building tomorrow’s smart cities to powering sustainable energy and modern healthcare, chemicals lie at the heart of UAE’s growth story. As Dubai and Abu Dhabi continue to scale their ambitions, the demand for quality, compliant, and future-ready chemicals is accelerating.

Chemical suppliers, exporters, and importers have a window of opportunity to align with:

✅ The UAE’s industrial vision

✅ The demand for sustainable products

✅ The push for green certifications and digitized logistics

Whether you’re supplying PVC for metro projects, IPA for hospitals, or polyacrylamide for enhanced oil recovery, the UAE chemical market is open and thriving.

FAQs

Q1: What is the most demanded chemical in the UAE construction sector?

PVC (Polyvinyl Chloride) and epoxy resins are among the highest-demand products.

Q2: Which country exports the most chemicals to the UAE?

India leads in terms of volume, followed by China and Germany.

Q3: Are green chemicals in demand in the UAE?

Yes, especially in healthcare and infrastructure, aligned with sustainability goals.